What Should You Do With Your Qualcomm Company Stock?

Qualcomm offers a generous benefits package to it’s employees. In addition to what you would expect from a typical Fortune 500 company, they also offer an employee stock purchase plan which has been a great benefit for employees working to build their financial assets. Qualcomm employees can enroll in this voluntary plan after being employed by the company for 30 days before the beginning of the next offering period. Employees may elect between 1-15% of their salary (post-tax) to be deducted over a 6-month period to go towards the purchase of company shares. When purchasing Qualcomm stock shares through this program, qualified employees receive a healthy 15% discount. Generally, the 6 month offering periods are from February 1st- July 31st and August 1st-January 31st.

Should You be Putting All Your Eggs in One Basket?

While the employee stock purchase plan can prove to be an amazing wealth building opportunity, this needs to be balanced against sound investment principles and risk tolerance concerns - especially when approaching or entering retirement. In line with the old saying, “Don’t put all your eggs in one basket,” investors need to consider how much of their net worth it makes sense to have concentrated in one company stock. It is not uncommon to see some households with more than 50% of their entire net worth concentrated in one company stock. While many going into retirement recognize the risk of this situation, few properly address these risks in their retirement plans. This happens for a few common reasons: emotional-nostalgic attachment, wanting to avoid taxes, wanting to maintain the status quo, or simply not being aware of different solutions to help efficiently diversify.

When holding concentrated, highly appreciated company stock going into retirement, you are magnifying your risk through exposure to systematic market risk - the risk inherent in the stock market AND idiosyncratic risk - the risk inherent in a single stock. It's important to note that while some individual company stock may sometimes meet or exceed the annualized compounded return of the broad markets, 7% adjusted for inflation, this comes with much higher risk than is usually unnecessary for those entering retirement. Even very stable companies can face unexpected losses due to unforeseen events such as competitive pressures, mergers and acquisitions, legal issues, management turnover, disruptive technology, etc. If the impacted company stock represents a large percentage of an investor’s retirement portfolio, a significant decrease in retirement assets can occur very quickly.

"The chance of gain is by every man more or less overvalued, and the chance of loss is by most men undervalued."

—Adam Smith, Wealth of Nations

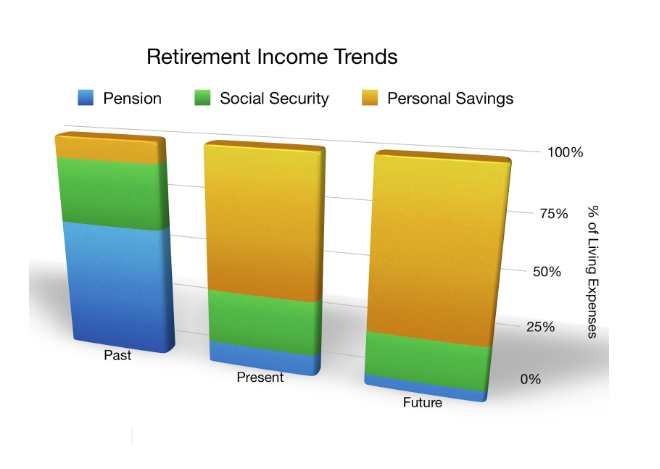

Now more than ever, you are expected to be completely responsible for planning and funding your own retirement. With the reality of living longer healthier lives, learning how to protect and efficiently distribute your nest egg in retirement is vital for long-term success.

Four Diversification Strategies to Consider

It is important to understand that the risks of holding too much of one stock as a percentage of your net worth can be efficiently mitigated with a few smart diversification strategies. These strategies are gradual and do not require a single “all or nothing” sale of stock to diversify your portfolio. They take taxes into account, can be stretched out over a few years, can sometimes generate added income streams, and can also fit nicely into legacy, charity, and estate planning.

These diversification strategies are best grouped into four main categories: SIMPLICITY, GIVING, HEDGING, and POSTPONING. The nice thing is that when developing your retirement plan, these strategies may be used separately or may be used in combination to best meet your goals. Considering which strategy or combination of strategies to use will depend largely on factors like cost basis, taxes, age, sales restrictions, income needs, and legacy. Each of these diversification strategies deserve their own article, but I will summarize them below, and if any of these peak your interest, you should consult an advisor to see how they might augment or improve your current retirement planning. Maintaining the status quo and hoping the markets treat you well is in effect an “all or nothing” approach that may not be your best option.

SIMPLICITY: This simple strategy takes advantage of systematic staged selling to slowly dollar cost average OUT of a concentrated stock position. By setting up a pre-planned, pre-scheduled series of sales, the investor is able to diversify out of concentrated company stock over time. This eases the burden of capital gains tax by spreading it out over a few years, and uses the proceeds of the systematic sales to reinvest in a more diversified - risk appropriate portfolio. The investor retains full control and can set up and adjust any schedule they choose. Investors can also time larger sales in lower income tax years. It may make sense to consider the cost basis of the shares to be put into this strategy to further mitigate capital gains tax.

GIVING: These strategie are built around charitable giving using charitable vehicles such as Charitable Remainder Trusts (CRT), Donor Advised Funds (DFA) and Total Return Pooled Income Funds (TRPIF). These strategies allow an investor to gift some portion of their highly appreciated company stock, reducing the impact of capital gains taxes while also gaining a significant income tax deduction at the same time. Using CRTs and TRPIFs can provide an income stream to help support retirement lifestyle, and can provide the intangible benefits of helping charities of choice to do good in the world. Family beneficiaries who would have otherwise received the assets being gifted into the CRT, DAF, or TRPIF, can be “made whole” with the use of life insurance to provide them an income tax free death benefit. This approach may make sense for low cost basis shares to protect them from losing value to capital gains tax. It also makes sense for those closer to retirement who could use the added income stream generated by the CRT and TRPIF vehicles.

HEDGING: This strategy is not so much geared towards diversification of concentrated stock as it is intended to protect the stocks’ value. Be warned, some hedging strategies may require qualification as an Accredited of Qualified investor. One approach uses options collars to protect on the downside in combination with calls on the upside to provide a cost effective way to protect the value of the company stock over a given period of time. Similar considerations apply for Prepaid Variable Forwards (PVF), committing a given value stock at a future date in trade for cash up front that can be used to reinvest in a more diversified-risk appropriate portfolio. These strategies are complex to set up and from a tax perspective, so they need to be well understood and carefully executed with the help of a tax professional. These may make sense for those holding restricted shares, or for younger investors who can better weather stock volatility due to a longer investment time horizon.

POSTPONING: Using Exchange Funds to diversify concentrated stock is an approach worth considering. However similar to some of the hedging strategies, it may require qualification as an Accredited of Qualified investor. Additional regulations may also require a net worth of at least $5 million. Exchange funds require a long-term investment horizon of at least seven years and can offer unique complexities to set up with regard to taxes. In most cases, capital gains taxes can be postponed, even through to future generations so there are both tax and estate planning considerations with the strategy. This may be a good fit for younger investors with low cost basis stock who want to diversify and postpone the capital gains hit that would result from a typical share sale.

What Should You Do?

True freedom in retirement is based on two simple concepts: freedom through discipline and freedom through planning. These concepts are simple, yet depending on your situation and your goals, the development and execution can be very complex. Remember, you only get one chance to retire, so it is best to get some help, invest the time to plan, and "buy" yourself the freedom and peace of mind you have worked so hard to deserve.

For each individual, your action steps depend on your particular situation, risk tolerance, and ownership incentive. If you’d like to evaluate your current situation and see what makes the most sense for you, I can help you understand your different options. Together, we can develop a plan to efficiently diversify your concentrated stock in such a way to augment your ongoing retirement planning.

You have worked very hard to build your retirement assets over decades. With the changing nature of retirement, making your assets and your income last longer is a key planning concern - it may be time to adjust your approach. Imagine how it would feel knowing you implemented smarter asset management and retirement planning, allowing you to possibly retire early, protect your long-term retirement goals, and leave a legacy to your loved ones.

To take the first step and schedule a complimentary 20-minute phone conversation, call 858-255-6703 or email ian.maxwell@revirescowealth.com.

About Ian

Ian Maxwell is a financial advisor and the president and CEO of Reviresco Wealth Advisory, an independent, fee-based firm dedicated to providing strategic wealth planning based on fiduciary standards. The firm leverages its independence to research unique ways to manage clients’ investment risk without sacrificing returns. Ian uses an educational approach to teach investors how to reduce investment fees, how to control tax-brackets in retirement and how to maximize legacy to loved ones. Ian focuses on serving successful pre-retirees who want to ensure the assets they’ve worked hard to build will work for them in return during retirement. He is passionate about improving the quality of life for his clients and developing innovative solutions that help people reconsider how to best achieve their financial goals. Based in San Diego, California, he works with clients locally, as well as in Northern California and the San Francisco/Bay area. To learn more, connect with Ian on LinkedIn, or send him an email at ian.maxwell@revirescowealth.com.

Investment Advisory Services offered through Retirement Wealth Advisors, (RWA) a Registered Investment Advisor. Reviresco Wealth Advisory and RWA are not affiliated. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

References:

https://larrycheng.com/2010/01/01/u-s-stock-performance-over-50-years/

https://www.accreditedinvestorleads.com/qualified-vs-accredited/

https://www.fidelitycharitable.org/philanthropy/charitable-remainder-trusts.shtml

https://www.estateplanning.com/Understanding-Charitable-Remainder-Trusts/

http://www.pgdc.com/pgdc/charitable-remainder-trusts

https://www.fidelitycharitable.org/philanthropy/what-is-a-donor-advised-fund.shtml

https://www.aefonline.org/what-donor-advised-fund

https://www.nptrust.org/what-is-a-donor-advised-fund

https://www.nptrust.org/donor-advised-funds/daf-advantages-and-limitations

http://www.pgdc.com/pgdc/best-kept-secret-planning-and-why-its-important-you

http://www.pgdc.com/pgdc/rebirth-pooled-income-fund

http://www.pgdc.com/pgdc/shhhhh-dont-tell-anyone

http://www.pgdc.com/pgdc/best-kept-secret-planning-and-why-its-important-you

https://www.uscharitablegifttrust.org/pooled-income-funds.php

https://alliancecommunityfoundation.org/pooled-income-fund-versus-charitable-remainder-unitrust/