How Much Life Insurance Do Qualcomm Employees Really Need?

Most people would agree that life insurance is an essential piece of the financial puzzle in that it protects those we love and makes their lives a little easier if the unthinkable were to happen. But despite its importance, more than 4 in 10 people don’t own a life insurance policy in any amount and 40% of those who do say they are under-insured. [1] Of the 59% of Americans who do carry life insurance, a third only have a basic group policy. Why is there such a disparity?

One probable reason is that life insurance can be complicated and is not a one-size-fits-all product. Everything from the type of insurance you obtain to the amount of coverage you receive will depend on your unique situation. Another reason is that life insurance is often low on the priority list compared to saving for retirement, debt reduction, basic living costs, and medical expenses. While there’s no exact formula, here’s a look at your current Qualcomm benefits and a few questions to answer that will help you evaluate your life insurance needs.

Do You Even Need Life Insurance?

The first question you should address is whether or not you even need life insurance in the first place. You’ll want to determine if you have enough money saved so that your death would not create a financial hardship for your loved ones. A single young adult with no dependents may not need life insurance if his loved ones can easily afford a funeral and burial. If you have several million dollars safely stored away, your death may not cause a financial hardship either, even if you still have a family depending on you.

If you don’t have enough money saved, you should purchase life insurance to protect your family in case you pass away. Even if you do have enough money saved, you may still want to consider purchasing life insurance for other benefits that it can provide, such as living benefits and diversification.

What Type Of Life Insurance Do You Need?

Along with knowing how much coverage you need, you’ll also need to choose the kind of life insurance that is most appropriate for your situation. The two primary types of life insurance are permanent and term.

Permanent Insurance

Permanent insurance is coverage that is not limited to a specific duration of time, meaning it can potentially last your entire life. There are several types of permanent insurance, including Universal Life, Indexed Universal Life, and Whole Life. The benefit of permanent insurance is that it can last longer than a term policy so that something will be paid to your beneficiaries no matter when you die (assuming your policy has been funded properly). This type of insurance is more expensive than term insurance, but this is due to the fact that permanent insurance represent a contract to pay a guaranteed death benefit to your beneficiaries no matter when you might die - assuming the policy is in good standing.

Term Insurance

Term insurance offers coverage for a specified length of time, which can be anywhere from 10 to 35 years in some cases. The downside to term insurance is that it only covers you for the specified length of time, so if you pass away after the term is over, no money is paid to your beneficiary. But depending on your situation, you may only need insurance for a certain time period — until your kids are grown or you have enough money saved to avoid financial hardship. One of the major benefits of term insurance, as opposed to permanent, is that it is usually the most inexpensive out-of-pocket option. One additional point to keeping mind is that statistically, 98% of Term policies never pay out the death benefit as most people outlive them or the policies might lapse. [2] Insurance companies can offer these more cheaply knowing there is only 2% of ever having having to pay a death benefit.

How Much Life Insurance Do You Need?

Finally, the question at the forefront of your mind. You’ll want to conduct a Needs Analysis, which can help you understand how much coverage you would need to protect your family adequately. Two of the biggest factors that affect how much insurance you need are your marital status and your financial dependents.

If you’re single without anyone — child or parent — depending on you financially, you’ll want enough to cover funeral and burial costs. It’s also important to have enough to cover debts, because not all debts are discharged in death, such as private student loans.

If you’re married, use the DIME method to consider your needs:

- Debt and final expenses

- Income

- Mortgage

- Education costs

After calculating and totaling each of those dollar amounts, apply an income replacement multiplier to determine your needed coverage amount. The multiplier varies based on your age and the status of your home mortgage. For example, if you’re under 50 years old, you can likely use a multiplier of 20. Older couples may be able to use a multiplier of 10 or 15, depending on the number of years left on their mortgage.

Keep in mind that these are just guidelines designed to give you a general idea of the amount of insurance coverage you need. There may be adjustments for your particular situation and what makes the most sense for your family.

How Much Life Insurance Does Qualcomm Offer?

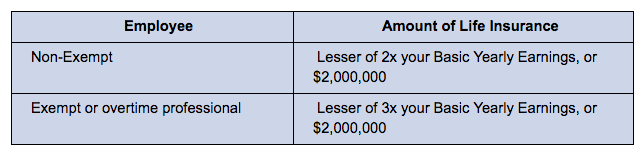

Like many companies, Qualcomm offers its employees group term life insurance coverage in the following amounts:

Remember, like any employee benefit, this coverage is only in effect if you continue working for Qualcomm. If you retire or leave Qualcomm, you have the opportunity to continue your life insurance with Securian Life Insurance and take over the premium payments yourself. [3]

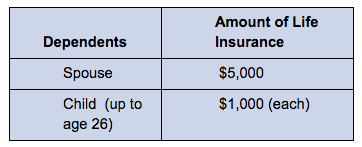

In addition, Qualcomm offers supplemental life insurance for you, your spouse, and your children. [4] This “Portable Life” program lets you choose to keep your term life coverage if and when you leave the company. The cost for your supplemental coverage will depend on your age and the amount you choose. Coverage is available for employees from $50,000 to $1,000,000, in $50,000 increments. For spouses, coverage ranges from $50,000 to $500,000, in $50,000 increments, and coverage for your children is available in amounts of $5,000 or $10,000.

How Do I Make The Right Decision?

There’s no one best way to choose a life insurance policy. By analyzing your current Qualcomm life insurance options and comparing the amount to the results of your Needs Analysis, you may realize you need more insurance to protect your loved ones. Keep in mind that when considering Permanent or Term life insurance, it does not have to be an “either -or” decision. The appropriate solution may be a mix of both. When making such a significant financial decision, it can be helpful to talk to a financial professional and review your options. Someone experienced with insurance policies and your company benefits can offer you guidance on the products available to you and how they can integrate into your other financial strategies. If you are concerned about your life insurance policy or would like to schedule a review or discuss your options, schedule a free 15-minute introductory phone call now!

About Ian

Ian Maxwell is a financial advisor and the president and CEO of Reviresco Wealth Advisory, an independent, fee-based firm dedicated to providing investment management and strategic wealth planning based on fiduciary standards. Providing comprehensive financial planning and asset management, Ian focuses on serving successful pre-retirees who want to help make the assets they’ve worked hard to build work for them in return during retirement. He is passionate about helping to improve the quality of life for his clients and developing innovative solutions that help people reconsider how to best achieve their financial goals. Based in San Diego, California, he works with clients locally, as well as in Northern California in the San Francisco area. To learn more, connect with Ian on LinkedIn, or send him an email at ian.maxwell@revirescowealth.com.

Investment Advisory Services offered through Retirement Wealth Advisors, (RWA) a Registered Investment Advisor. Reviresco Wealth Advisory and RWA are not affiliated. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

_______

[1] https://www.bestliferates.org/blog/2017-life-insurance-statistics-and-facts/

[2] https://www.huffingtonpost.com/wm-scott-page/the-life-insurance-indust_b_1937246.html