How Does Your Retirement Savings Compare To Your Qualcomm Peers?

Planning for retirement can be one of the most challenging endeavors people undertake. There is so much information out there, so many strategies, and so many calculators. Just a simple Google search will give you an overwhelming amount of responses.

Depending on who you talk to or what website you read, much of the information can seem contradictory. Some experts say you need a certain number to retire, while others say you just need to focus on paying off debt. You may hear that people won’t be able to retire until 70 while others claim they will retire early. But what really is the answer? Well it depends on each person or families situation - there is no “One-Size-Fits-All” solution out there. Retiring isn’t as simple as it used to be now that we are living longer and pensions are becoming more scarce, putting more of the retirement planning burden on the individual investor. It’s up to you to determine what you want your retirement to look like. What lifestyle do you desire in retirement? Do you have a plan to actually make that happen? Will your plan protect you through different life events, economic cycles, or political changes?

How Do Your Savings Compare to the General Population?

Baby Boomers are now retiring an an estimated rate of 10,000 per day. The Census Bureau even predicts that the population over age 65 will grow 50% from 2015 to 2030. The US Government Accountability Office (GAO) is working to find out how well prepared American workers are for retirement. A report from 2015 outlines the retirement savings of people between the ages of 55 and 64. The information below can help you get an idea of how you sit compared to the general population.

If You’re Between the Ages of 55 and 64

You may be surprised, but if you have at least $1 saved for retirement, you’re doing better than 41% of those in the report. If you have at least $25,000 saved, you’re in the top 59%. It’s possible you may feel pretty good if you’ve saved more than this, but you will need a real plan to get the comfortable retirement you desire, and that may include more retirement assets. You may not know exactly how much you need, but odds are, you’ll need more than $25,000.

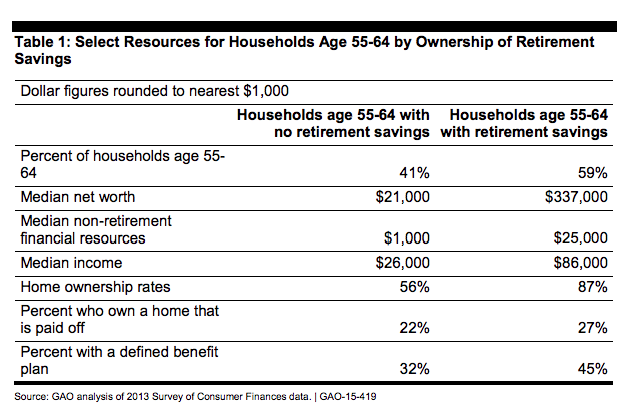

The table below divides households with no retirement savings and those who have that are 55-64.

Those who have not saved for retirement will be dependent on pensions (if they have one), Social Security, and potentially their family and friends for help. They may also have to work well into their normal retirement years, pushing until their physical health may force them to stop. According to Table 2 below, of those that have saved, the average household has about $104,000. Likely these number are a little higher now that it’s 2018. Either way, $104,000 isn’t going to provide enough income for most people to keep up with longer life spans, inflation, taxes and rising healthcare costs.

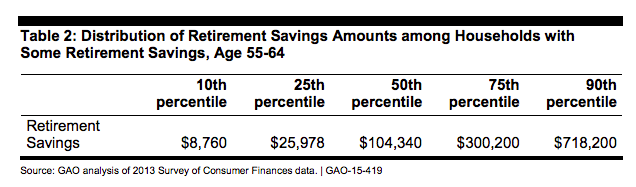

In Table 2, you can see how much the general population have actually managed to put away. Where do you fit in?

What factors contribute to the 90th percentile being over $700,000 while the 50th percentile sits at $104,000? Is it higher income, better benefits packages at work, more discipline, or a combination of all of them?

If You’re Between the Ages of 65 and 74

Currently, age 65 is the “benchmark” retirement goal for most households. At that age, you enroll into Medicare, and soon you’ll be able to draw your full amount from Social Security. Many people are waiting until after 65 because they don’t have enough saved for retirement.

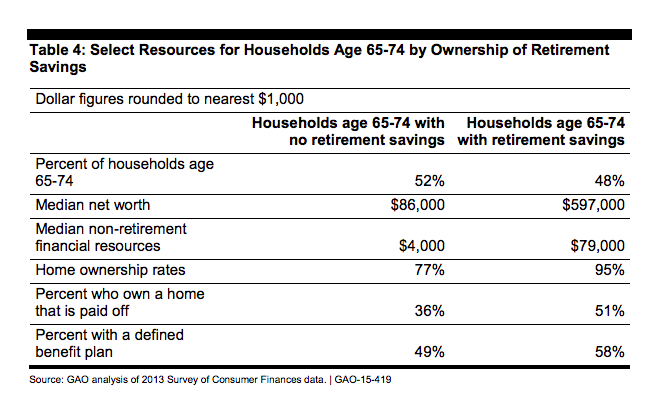

Similar to the younger age group, those aged 65-74 don’t have very much in savings either. Here is a chart showing the exact same information for those already at retirement age.

In this age group, people are a somewhat more prepared with a slightly larger nest egg. The average net worth is more and homeownership rates are higher. Let’s look at their savings breakdown.

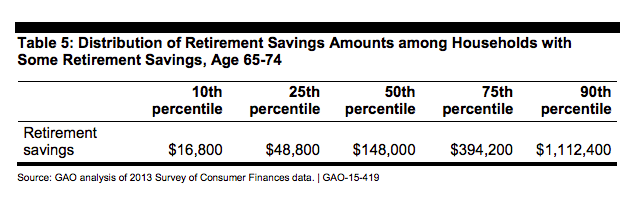

Surprisingly, the average amount saved is not that much higher than that among households aged 55-64, only increasing from $104,000 to $148,000. Where do you fall if your in this age range? If you’re in the 90th percentile, you’re likely feeling very good and probably don’t have anything to worry about in retirement. But what about the lower percentiles?

The fascinating thing about this study is that it doesn’t take a whole lot of savings to look good compared to your peers. But because you need to base your plans on what’s right for you and your family, you need to look at what your savings will provide for your desired retirement. Will you have enough to live the life you want? Or do you need to maximize your savings in the years leading up to your retirement?

How do Qualcomm Employees Compare?

It’s obvious that employer plans such as 401(k)’s that utilize automatic paycheck contributions as well as the company match contribute significantly to the retirement readiness of some Americans. According to the Qualcomm Employee Savings and Retirement Plan Form 5500 filed in 2016, the average employee added $14,035 into their 401(k). The company average match was $4,538 with the average 401k balance across all employee’s being $231,986. Clearly, some employees are contributing much more than others and therefore have higher 401(k) balances. But having the average employee with $200-$300,000 is remarkable. As detailed above, the average household in America age 55-64 had $104,000 and age 65-74 had $148,000. This is very impressive for Qualcomm given the fact that the technology industry also tends to employ younger people. The future of those working at Qualcomm and in the tech industry looks very bright when comparing their retirement to national averages.

The generous benefits package Qualcomm employees receive also play a significant role in helping them save and prepare for retirement. Many technology industry employees have typically achieved higher levels of education which helps them to be more disciplined when saving and planning for the future. It is important to note that the numbers mentioned above only include the money within the Qualcomm 401k plan. These numbers do not include the employee’s entire household portfolio of assets such as company stock, outside retirement accounts - IRAs, Roth’s, old 401k’s - individual brokerage accounts, real estate, etc… Nor does it account for spousal assets and retirement savings. It’s very clear that Qualcomm employee’s are significantly better prepared than the average American household. While it does take long-term discipline and planning to accumulate the necessary savings to fund a desirable retirement, it takes an equal level of discipline and planning to carefully turn accumulated assets into a secure stream of income that will last through the 20-30 years after you stop working. It is important to note that the distribution strategies necessary to properly fund your retirement are very different than those used during the accumulation phase leading up to retirement. Having a proper retirement plan in place is absolutely necessary to make sure that assets and income do not run out one day.

How Much Do You Need For Retirement?

No matter how you compare to others, you have to figure out what you actually need for your desired retirement lifestyle. With all the information out there online as well as what you may hear from family, friends, and coworkers, determining the amount you need to save, and planing how to actually distribute it may seem very foggy and elusive. The best way to clearly quantify your retirement goals and to develop a plan that mathematically illustrates how to safely distribute your asses over the 20-30 year period after you stop working is to have a professional advisor partner with you. While they will use technology and different calculators to work out the math, they should also bring a specialized level of expertise on the “human side” of things. Effectively showing retirees how to retire comfortably, and more importantly, how to stay comfortably retired for a long time requires a careful blend of math and psychology to help keep everything on track.

Why Clients Choose Us

What sets us apart from many other firms is our ability to look beyond the management of investment assets when developing a financial value proposition for our clients. While the management of investment accounts is an important part of the overall planning process that we do help with, we also spend time gathering as much information as we can about our clients in all areas of their lives. This extra level of investigation and understanding often allows us to uncover previously unrecognized or untapped areas of opportunity. These may come in the form of tax planning, estate planning, beneficiary alignment, or some combination to name a few.

As a result of working through our planning process, we also encourage our clients to think in a way that goes beyond the pure money management. Too often, people assume an advisor is only interested in their investable assets, however, we find the real value we add often goes far beyond this one are of someone's financial life. We are focused on helping our clients feel confident by working with us to develop and implement a comprehensive financial plan that takes all aspect of their life into consideration. This includes understanding the purpose for their money, having a plan and resources in place for unexpected life events, and understanding how taxes impact their retirement income planning. All of this can have a much more positive impact when compared to solely looking at portfolio performance.

Beyond the value of our services, clients tell us how much they appreciate our honesty and transparency. We believe clients know we have their best interests in mind and at heart.

How We Work

Simplicity is important to us, so we’ve developed a streamlined yet comprehensive process. It all starts with getting to know one another during a 20-30 minute phone call. This gives us a chance to get acquainted and learn more about one another. Together, we’ll decide if it makes sense to take the next step, which is a complimentary in-person initial consultation. During this discussion, we’ll dive into your finances and get a better understanding of your current situation, future goals, and how we might best be of value.

From there, if we decide to work together, we’ll develop your financial plan and meet regularly to monitor and make adjustments as needed.

Take Action

If you’re approaching retirement and have questions about income needs, estate planning, tax planning, or other financial concerns, we’d be happy to discuss your situation and help you understand your best way forward.

To take the first step and schedule a complimentary 20-30 minute phone conversation, call 858-255-6703 or email ian.maxwell@revirescowealth.com.

About Ian

Ian Maxwell is a financial advisor and the president and CEO of Reviresco Wealth Advisory, an independent, fee-based firm dedicated to providing strategic wealth planning based on fiduciary standards. The firm leverages its independence to research unique ways to manage clients’ investment risk without sacrificing returns. Ian uses an educational approach to teach investors how to reduce investment fees, how to control tax-brackets in retirement and how to maximize legacy to loved ones. Ian focuses on serving successful pre-retirees who want to ensure the assets they’ve worked hard to build will work for them in return during retirement. He is passionate about improving the quality of life for his clients and developing innovative solutions that help people reconsider how to best achieve their financial goals. Based in San Diego, California, he works with clients locally, as well as in Northern California and the San Francisco/Bay area. To learn more, connect with Ian on LinkedIn, or send him an email at ian.maxwell@revirescowealth.com.

Investment Advisory Services offered through Retirement Wealth Advisors, (RWA) a Registered Investment Advisor. Reviresco Wealth Advisory and RWA are not affiliated. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.