Our core belief is that the best way we can help improve your financial situation is to find money you are losing unknowingly and unnecessarily. By leveraging the collective insights of our subject matter experts in the key areas of finance, we are able to identify and address inefficiencies that could be costing you in the long run. We believe there is more to gain by avoiding unnecessary losses than by simply chasing rates of return.

Whether you are dealing with a significant financial issue like tax optimization, efficiently selling a business or property that has appreciated in value, or working through a recent inheritance, or maybe you are simply ready to redefine your relationship to wealth, we offer you comprehensive financial services and scalable support. Your most deeply held values and your most important goals inform and dictate the nature of our relationship, so breathe easy and relax as we work together to help you find clarity, take control and accelerate the trajectory and growth of your personal wealth.

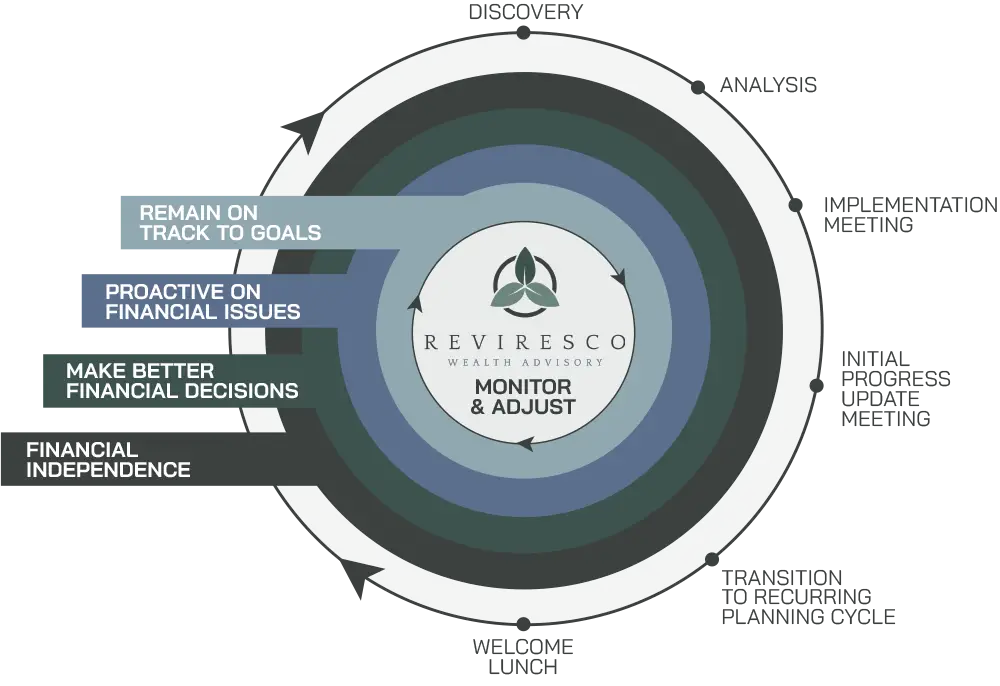

Reviresco leverages its independence to unique team structure to help our clients manage any significant financial issues that may arise. We use an educational approach to teach clients how to reduce investment fees, optimize tax-brackets, live their dream retirement and how to maximize legacy to loved ones. We stress to everyone that successful financial and retirement outcomes are absolutely dependent on having a responsive comprehensive written lifetime financial strategy in place. We believe, “Your financial plan is the benchmark.”